In this review, you'll get an inside look at the key features Spotgamma offers to help improve your options trading. Whether you're an experienced trader looking to step up your game or just getting started with options, Spotgamma gives you the insights you need to trade with confidence. Read on to see how Spotgamma can take your options trading to the next level.

The Essential Spotgamma Review for Serious Options Traders

As an options trader, you know that success depends on making informed decisions based on accurate data and analysis. Spotgamma is an essential tool for serious options traders looking to gain an edge. Their platform provides real-time data and visualizations to help you better understand options flow and make strategic trading decisions. In this review, you’ll get an inside look at the key features Spotgamma offers to help improve your options trading. Whether you’re an experienced trader looking to step up your game or just getting started with options, Spotgamma gives you the insights you need to trade with confidence. Read on to see how Spotgamma can take your options trading to the next level.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

What Is Spotgamma and Who Created It?

Spotgamma is an options analysis and trading platform created by options traders for options traders. Founded in 2020, Spotgamma provides sophisticated yet intuitive tools for analyzing risk, finding opportunities, and making strategic trading decisions.

Spotgamma’s platform focuses on two key metrics: gamma and charm. Gamma measures the rate of change of delta, which is how much an option price changes relative to a $1 move in the underlying stock. Charm measures the rate of change of gamma. These “second-order Greeks” are pivotal for understanding options behavior, especially for earnings and events.

Spotgamma offers an array of features for informed options trading:

- Live options data, including real-time gamma and charm, for thousands of stocks and ETFs. Data is updated every 5 seconds during market hours.

- Customizable options analytics, charts, and trading tools. View historical and live data for gamma, delta, theta, vega, and more. Create spreads, straddles, and other advanced positions.

- Earnings and event analytics. See how options are pricing in volatility for upcoming catalysts. Spotgamma provides estimates of post-earnings stock price moves based on options.

- Education and insights. Learn options theory and advanced strategies through Spotgamma’s blog, video library, and weekly newsletter.

Whether you’re an experienced options trader looking to gain an edge or a beginner seeking to build knowledge and skills, Spotgamma is an invaluable resource. The platform’s innovative approach to options analytics can help you make smarter, more strategic trades. For serious options traders, Spotgamma is an essential tool.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

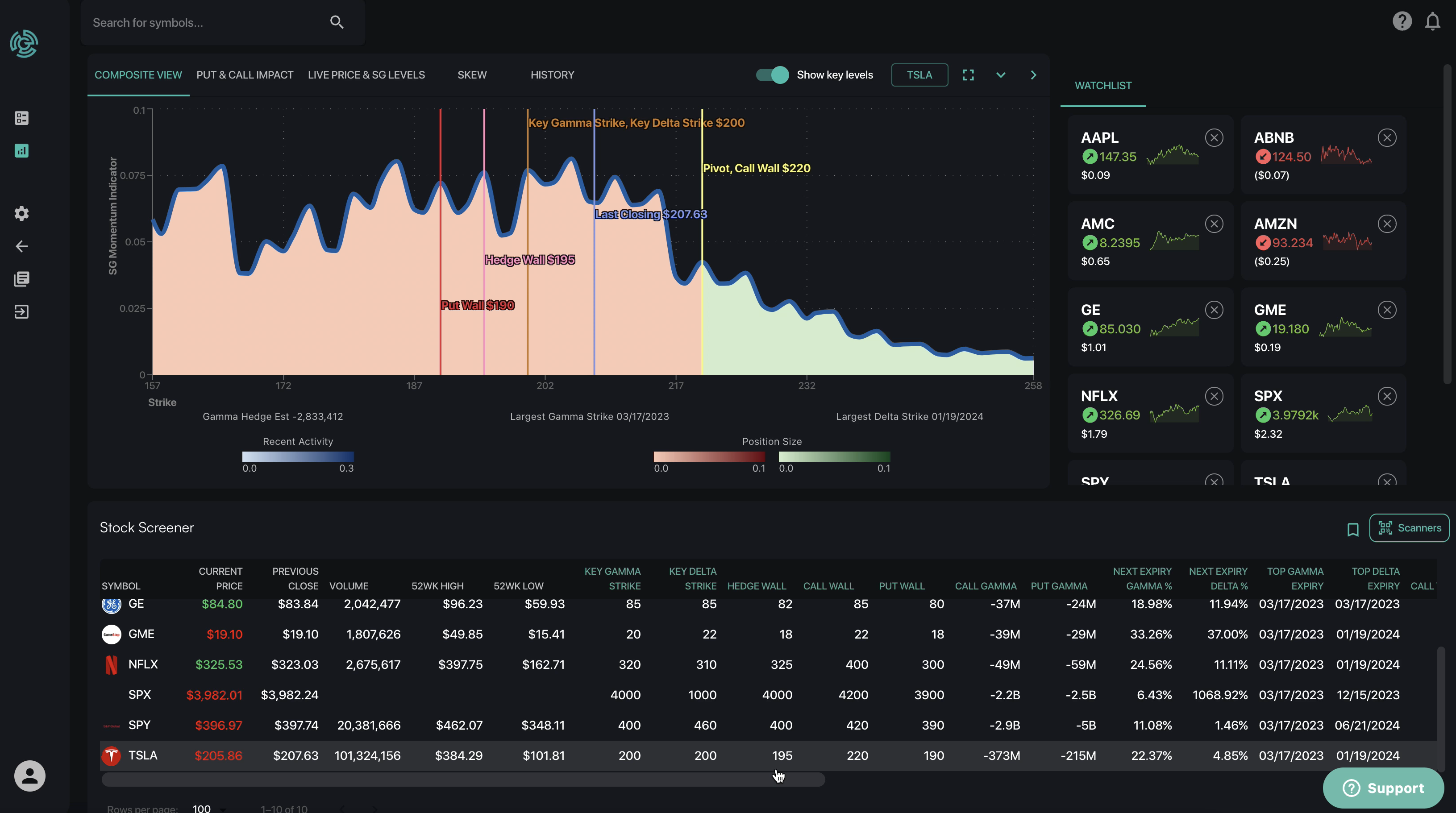

Spotgamma Options Analysis Tool Features

The Spotgamma options analysis tool provides essential insights for serious options traders. Some of the key features include:

- Real-time options data: Spotgamma aggregates real-time options data from all major exchanges to provide a complete view of the options market. You’ll have up-to-the-second data on options volumes, open interest, implied volatility, and more for thousands of stocks and ETFs.

- Implied volatility analytics: Spotgamma calculates implied volatility for individual options and uses it to generate volatility surfaces, volatility skew charts, and other advanced volatility metrics. This helps you identify relative value opportunities and make better trading decisions.

- Options flow insights: Spotgamma uses a proprietary algorithm to analyze options flow and determine whether activity is being driven by institutions, hedge funds, or retail traders. This “smart flow” analysis provides an informational edge and helps you follow the smart money.

- Custom alerts: You can set up custom alerts to notify you when options flow, volatility, or other metrics reach certain thresholds for stocks you care about. Alerts are delivered instantly via mobile push notification, SMS, email or web browser.

- Advanced charting: Spotgamma includes advanced options charting with features like volatility surfaces, skew charts, open interest, volume, and more. You can visualize options data to spot trends and patterns. Charts are highly customizable and shareable.

- Education and community: Spotgamma provides educational resources to help you improve your options trading skills. You can also join the Spotgamma community to connect with other experienced options traders, share ideas, and discuss the latest market events.

With its powerful options data, analytics, and tools, Spotgamma is an essential resource for active options traders looking to gain an edge in the market. The platform is web-based, so you can access your account and stay on top of the options market from anywhere 24/7.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

How Spotgamma Helps Options Traders

Spotgamma is an essential tool for serious options traders looking to gain an edge. It provides sophisticated data and analytics to help identify opportunities and make better trading decisions.

Advanced Options Data

Spotgamma gives traders access to detailed options data, including open interest, volume, and volatility metrics for all available option chains. This allows traders to see unusual activity that could signal a trading opportunity. Spotgamma also tracks changes in open interest and volume over time so traders can identify trends.

Cutting-Edge Analytics

Spotgamma applies machine learning and statistical analysis to options data to detect anomalies and surface insights. Some of the key analytics include:

- Implied volatility analysis: Spotgamma measures implied volatility for individual options and at the portfolio level. Traders can see how implied volatility changes over time and compare to historical volatility.

- Options flow analysis: Spotgamma uses options flow data to determine if activity is bullish or bearish. It aggregates flow by expiration date, strike price, and other factors to detect unusual flow that could influence stock price.

- Gamma exposure: Spotgamma calculates portfolio gamma, theta, and other Greeks. Traders can see how exposed they are to changes in the underlying stock price and make adjustments to hedge risk.

- Spread scanner: Spotgamma scans the options market for spreads with a high probability of profit. It considers factors like implied volatility, time to expiration, and options flow to find spreads that are poised to gain value.

Customizable and Intuitive

Spotgamma has an intuitive interface that allows traders to customize data and set up alerts. Users can filter options data by expiration date, moneyness, and other factors. The platform makes it easy to compare data across different time periods. Traders can also set up alerts to notify them when the metrics they care about hit certain thresholds so they can act fast on new opportunities.

For serious options traders, Spotgamma is an invaluable tool that provides a data-driven edge in the market. The advanced analytics and customizable interface give traders actionable insights that would otherwise be difficult to uncover. Overall, Spotgamma is a must-have resource for any options trader looking to improve their performance.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

Spotgamma Pricing and Plans

Free Trial

Spotgamma offers a free 14-day trial of their platform so you can experience the full capabilities before committing to a paid subscription. The trial includes access to all features, data, and tools so you can determine if the service suits your options trading needs. At the end of the 14 days, you’ll need to choose one of their monthly or annual pricing plans to continue accessing the platform.

Monthly and Annual Plans

Spotgamma has two straightforward pricing options: monthly or annual subscriptions. The monthly plan is $99 per month, billed monthly, and can be canceled at any time. The annual plan is $990 per year, billed annually, which equates to $82.50 per month and saves you 17% compared to the monthly fees.

Both plans provide unlimited access to the Spotgamma platform, including:

- Options flow insights and visualizations

- Custom watchlists and alerts

- Options volatility and Greeks analysis

- Options open interest tracking

- Options flow sentiment indicators

- Options flow heatmaps and histograms

- Options flow unusual activity screeners

- Options flow top movers

- Options flow biggest trades

For serious options traders, the annual plan is the most cost-effective choice if you plan to use the platform consistently for your analysis and trading decisions. The monthly plan may be better suited if you want to evaluate the service for a longer trial period before committing to an annual subscription.

In summary, Spotgamma aims to provide sophisticated options analysis and trading tools for a very reasonable price. For under $100 per month, the platform gives options traders valuable data and insights that would otherwise be difficult and time-consuming to uncover manually. The free trial and choice of monthly or annual plans make the service accessible to options traders with any budget.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

Getting Started With Spotgamma

Getting started with Spotgamma is straightforward for options traders of any experience level. To begin analyzing options data and uncovering trading opportunities, simply follow these steps:

Create an Account

Visit Spotgamma.com and click “Sign Up” to create your free account. Enter an email address and password to register. Your account will include access to Spotgamma’s full suite of options analysis tools and educational resources.

Connect Your Brokerage

Link your brokerage account(s) to automatically import your options positions and trading data into Spotgamma. This allows the platform to provide customized insights based on your unique positions and trading style. Connecting an account is optional but recommended to maximize the benefits. Most major brokerages are supported.

Explore the Tools

Spotgamma offers powerful yet intuitive tools for analyzing the options market. Some of the key features include:

- Options Positions: View details on all your open options positions in one place. See Greeks, implied volatility, probability of profit, and more.

- Options Flow: Monitor options trading volume to see where large traders are positioning. Unusual options flow can signal trading opportunities.

- Options Charts: Visualize options data through interactive charts. Chart options volume, open interest, IV, Greeks, and custom spreads. Identify trends and patterns.

- Options Screener: Filter through thousands of options contracts to find trading opportunities that match your criteria. Screen by expiration, strike, volume, IV, and other parameters.

- Options Alerts: Set up custom alerts to notify you when the options market conditions change in your favor. Get alerts on price, volume, flow, IV, and spread moves.

Dive into Education

Improve your options trading skills through Spotgamma’s education portal. They offer video courses, blog posts, podcasts, and live webinars covering options fundamentals, volatility, spreads, Greeks, and advanced trading strategies. The education content provides helpful context around how to analyze the options market data and use the Spotgamma tools effectively.

With powerful yet intuitive tools and resources for analyzing the options market, Spotgamma gives you an edge in finding and capitalizing on trading opportunities. The platform is designed for options traders of all experience levels. Getting started is easy—just create your free account and you’ll be unlocking the full potential of options data in no time.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

The Spotgamma Mobile App Experience

The Spotgamma mobile app provides an optimized experience for options traders on the go. All of the essential tools and features from the web platform are available in an intuitive interface tailored for smaller screens.

Powerful Yet Easy to Use

The Spotgamma mobile app is designed to be powerful yet easy to use. All of the advanced options analytics and trade ideas are just a few taps away. The clean, minimal interface focuses on the most important information and tools so you can analyze the market and find trading opportunities quickly.

Real-Time Data and Alerts

With the Spotgamma mobile app, you have real-time access to options data and greeks for your positions and watchlists. Set up custom alerts to notify you of price movements, changes in volatility, and other events so you never miss an important development. Receive push notifications instantly on your mobile device.

Seamless Synchronization

Your Spotgamma account, positions, watchlists, and settings are seamlessly synchronized between the web platform and mobile app. Pick up right where you left off and stay on top of the options market wherever you are. Any changes made in one platform are automatically updated in the other.

Offline Access

The Spotgamma mobile app provides offline access to your saved data, positions, and watchlists. View historical data, charts, and analytics even when you don’t have an internet connection or cell service. Your data is securely stored on your device until connectivity is restored, then automatically synced with your Spotgamma account.

For serious options traders, the Spotgamma mobile app is an essential tool that provides a complete, optimized experience on any iOS or Android device. All of the power and functionality of the web platform is available at your fingertips wherever you go. Stay on top of the options market and never miss an opportunity with Spotgamma.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

Spotgamma Customer Support and Resources

Spotgamma provides exceptional customer support and resources for subscribers. Their team is dedicated to ensuring you get the most out of their platform and options analysis tools.

Live Chat and Email Support

Spotgamma offers live chat support on their website during market hours, as well as email support 24 hours a day. Their support staff are extremely knowledgeable about options trading and the Spotgamma platform. They can help answer questions about specific options strategies, explain indicators and signals, or troubleshoot any issues.

Video Tutorials and Webinars

Spotgamma has an extensive library of video tutorials and webinars covering all aspects of options trading and how to use their platform. The videos range from introductory level overviews for beginners up to advanced strategies and technical analysis for experienced traders. They frequently host live webinars on popular topics which are all recorded and available on-demand.

Blog and Newsletter

Spotgamma publishes a blog with frequent posts on options trading strategies, market analysis, volatility trends, and more. They also send out a weekly newsletter highlighting the latest blog posts, updates to their platform, upcoming webinars, and actionable options trading ideas. The blog and newsletter are valuable resources for staying up-to-date with options trading knowledge and the Spotgamma platform.

Facebook Group and Twitter

For those interested in connecting with other Spotgamma users, they have an active Facebook group and Twitter profile. The Facebook group allows traders to discuss options strategies, ask questions, share trade ideas, and network. Spotgamma’s Twitter feed provides platform updates, blog post highlights, trading tips, and market commentary.

Overall, Spotgamma offers an exceptional level of customer service and resources for options traders. Between live support, tutorials, webinars, blog posts and social media, you will have all the tools and knowledge needed to become a successful options trader using their platform. The resources and community they provide are unmatched in the options analysis industry.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

Pros and Cons of Using Spotgamma

Using Spotgamma as an options analysis tool provides both advantages and disadvantages for serious traders to consider.

Pros of Spotgamma

- Access to real-time data and analytics on options trading activity, volatility, and risk exposures across major markets. This allows for faster, more informed trading decisions based on institutional money flows and positioning.

- Customizable layouts and watchlists to focus on specific options, underlying stocks, spreads, or strategies of interest. Traders can filter and sort data to instantly see opportunities and risks.

- Visualization tools like heat maps, histograms, and scatter plots provide an intuitive sense of options landscape and sentiment. This can reveal trends not obvious from numbers alone.

- Educational resources help traders better understand options concepts and the “why” behind the numbers. This leads to more strategic trading rather than reactive.

- Integrations with major brokers allow for seamless trading directly from the platform. No wasting time toggling between screens and tools.

Cons of Spotgamma

- The platform and data can seem overwhelming to new options traders or those unfamiliar with volatility metrics and positioning analysis. A steep learning curve is required to use Spotgamma effectively.

- Cost may be prohibitive for small retail traders or those just starting out. Subscription fees, while typical for professional platforms, cut into potential profits.

- Reliance on a single options analysis tool could lead to “echo chamber” effect. It is easy to miss alternative perspectives or contrarian signals that may emerge across other data sources.

- As with any technology system, there is potential for errors, inaccuracies, or downtime that could impact trading decisions or opportunities. It is unwise to depend entirely on any single tool.

Using Spotgamma, while valuable for professional options traders, requires an understanding of its limitations and risks. When combined with other resources, it can enhance trading precision and performance. But for beginners, its complexity may outweigh potential benefits until sufficient knowledge and experience is gained. With time and practice, Spotgamma’s pros can outweigh the cons.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

FAQs About Spotgamma and Options Analysis

What is Spotgamma?

Spotgamma is an options analysis tool used by serious options traders to gain an edge in the market. It provides real-time data and visualizations of options flow, volatility, open interest, and more to identify trading opportunities.

How does Spotgamma work?

Spotgamma aggregates options data from all major exchanges in real time. Their algorithms then analyze the data to detect unusual options activity that could signal a price movement in the underlying stock. As an options trader, you can use the Spotgamma platform to see options flow, analyze trends in volatility, and find potential trading signals to place strategic options trades.

What features does Spotgamma offer?

Some of the key features in Spotgamma include:

- Options flow: See real-time options volume and flow to spot unusual activity.

- Volatility analysis: Analyze historical and implied volatility to determine opportune times to buy or sell options.

- Open interest: View open interest by strike price to see where other traders have positions.

- Price alerts: Set alerts to notify you of a change in options flow or volatility so you can act quickly.

- Customizable charts: Create customizable charts to visualize options data and spot important trends.

- Education: Access a knowledge base of options trading resources to continue improving your skills.

How much does Spotgamma cost?

Spotgamma offers three pricing tiers based on features and data access:

- Basic: Free. Delayed options data, limited features. For learning purposes.

- Pro: $99/month. Real-time options data, full platform access. For active options traders.

- Elite: $299/month. Enhanced options data, proprietary indicators, unlimited API access. For professional options traders.

Spotgamma offers a 14-day free trial of their Pro and Elite plans. They also provide discounts for annual subscriptions and for students.

Is Spotgamma right for you?

If you’re a serious options trader looking to gain an edge with real-time data and analytics, Spotgamma could be an invaluable tool for your trading. However, if you’re new to options trading or on a tight budget, you may want to start with their free Basic plan or another free resource to learn the basics before investing in their paid subscription service.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

Conclusion

As an options trader, you need the best tools and data to gain an edge. Spotgamma provides an essential service for serious traders looking to make informed decisions based on statistical analysis and probability. Their platform gives you insights into options flow and volatility that would otherwise take an enormous amount of time and effort to compile manually. For a reasonable subscription fee, you get access to the metrics and visualizations you need to improve your options trading strategy. If you’re ready to take your options trading to the next level, Spotgamma is a must-have resource. Their team of experts is constantly improving the platform based on the latest research and technology. For any options trader looking to trade smarter and gain a competitive advantage, Spotgamma should be the first place you turn.

CLICK HERE TO EXPERIENCE SPOTGAMMA▶▶▶

:max_bytes(150000):strip_icc()/Primary-Image-how-to-trade-0dte-options-7481013-c9af6887219942dc9c8c9374963b51ec.jpg)