How Koinly Transformed My Crypto Tax Reporting Experience

As an avid cryptocurrency investor, you have likely experienced the headache of calculating capital gains and losses for your crypto trades to report on your taxes. The countless transactions across multiple exchanges quickly become an accounting nightmare. However, crypto tax software has emerged as a solution to simplify the entire process. Koinly is one such platform that can transform how you handle your cryptocurrency taxes. By connecting all your wallets and exchanges in one place, Koinly provides an automated solution to generate your required tax reports with the click of a button. No more sifting through thousands of trades or figuring out how to calculate your gains and losses. Koinly does all the work for you so you can focus on growing your crypto portfolio rather than dealing with the accounting. If you’re looking to streamline your crypto tax reporting for this year, Koinly may be the solution you’ve been searching for.

Why I Needed a Crypto Tax Solution

As an active cryptocurrency investor and trader, I needed a solution to help me keep track of my complex crypto transactions and report my capital gains taxes. I tried using a spreadsheet, but it quickly became unwieldy and error-prone. That’s when I discovered Koinly, an automated crypto tax reporting tool.

Koinly imports all your crypto transactions from exchanges, wallets, and blockchains and accurately calculates your capital gains and losses. It supports over 300 crypto exchanges and wallets, including popular options like Coinbase, Binance, Ledger, and Trezor. Koinly uses first-in-first-out (FIFO) accounting to determine your cost basis and capital gains for each transaction.

One of the biggest benefits of Koinly is how it simplifies the crypto tax reporting process. You no longer have to manually track and calculate your gains and losses across thousands of transactions. Koinly does all the work for you and provides useful reports that are ready to file with your taxes. It generates the necessary tax forms like the 8949 and Schedule D to report on your annual tax return.

For U.S. citizens, Koinly also helps ensure you remain compliant with the IRS’s crypto tax guidelines. It provides audit trails and supporting documentation for all calculations in case of an IRS audit. The software is very affordable, with plans starting at $49 per tax year. For most crypto investors, Koinly is a must-have tool that will save you time, hassle, and potentially money come tax season.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

How I Found Koinly Crypto Tax Software

As a long-time cryptocurrency investor, reporting my crypto taxes each year was an arduous process that I dreaded. I spent hours sorting through hundreds of trades, calculating gains and losses, and filling out complex tax forms. That is, until I discovered Koinly crypto tax software.

Koinly made crypto tax reporting simple and stress-free. After connecting my wallets and exchanges, Koinly automatically imported all my transactions, matched transfers between my accounts, and calculated my capital gains and losses.

Using Koinly, I was able to generate my necessary tax reports in minutes. Koinly created an audit-ready capital gains report, income report, and Form 8949 for my Schedule D — all I had to do was review and file.

Beyond the time savings, Koinly gave me peace of mind that my crypto taxes were calculated accurately and in full compliance with regulations. Koinly stays up-to-date with the latest crypto tax rules and guidelines to ensure your reports are prepared properly. They also offer full audit support in the unlikely event of an IRS inquiry into your crypto transactions.

For a small fee, Koinly offered a simple solution that saved me days of work and gave me confidence that my cryptocurrency taxes were handled correctly. If you own cryptocurrency, I highly recommend trying Koinly to simplify your tax reporting and avoid issues with underpayment or non-compliance. Koinly supports over 6,000 cryptocurrencies and 300+ exchanges so you can rest assured your entire crypto portfolio will be covered.

Give Koinly a try — your future self will thank you come tax season!

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Signing Up and Connecting My Exchanges

To get started with Koinly, you first need to sign up for an account and connect your cryptocurrency exchanges and wallets.

Creating an Account

Visit Koinly.io and click “Sign Up” to create your free account. Enter an email address and password to set up your login credentials. Koinly does not require any personal information to create an account.

Connecting Exchanges

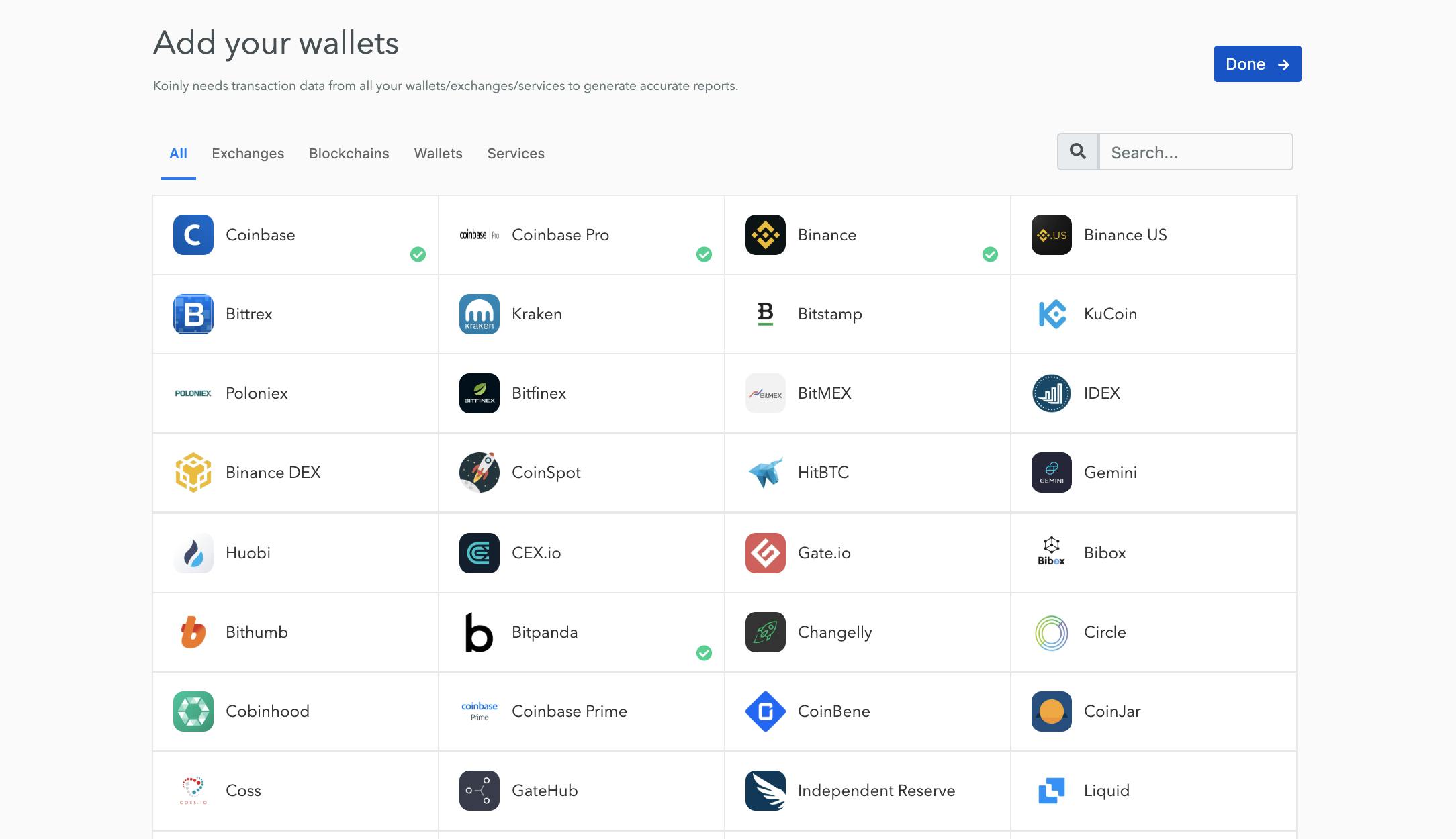

The next step is to connect your crypto exchanges and wallets so Koinly can import your transaction data. Koinly supports over 300 exchanges and wallets including Binance, Coinbase, Kraken, KuCoin, and Trust Wallet.

To connect an exchange, log in to your Koinly account and click “Connect Exchange.” Search for your exchange and follow the instructions to connect your API keys. API keys grant Koinly read-only access to import your transaction data. Koinly does not have any ability to withdraw or move your funds.

For added security, you can enable 2-factor authentication on your exchanges and wallets. You should also only enter API keys from legitimate exchanges that you personally use. Never enter keys from unknown sources.

Reviewing and Categorizing Transactions

Once your exchanges are connected, Koinly will automatically import your transaction data and match transfers between your accounts. Koinly uses advanced algorithms to categorize your transactions, detect transfers, and identify the correct cost basis for your crypto assets.

However, the algorithms cannot determine the purpose or context behind every transaction. You should review all your transactions to ensure they are properly categorized. You can recategorize transactions as needed by selecting a transaction and clicking “Recategorize.” Common categories include Trading, Mining, Staking, Gifts, and Lost or Stolen.

Properly categorizing and reviewing your transactions is important for generating an accurate tax report. Koinly allows you to customize categories and add tags to transactions to keep good records of your crypto activity. By taking the time to set up Koinly correctly, you can simplify your crypto tax reporting and feel confident in the accuracy of your reports.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Importing My Transactions: A Smooth Process

Connecting My Exchanges and Wallets

To get started with Koinly, I needed to connect all of my crypto exchanges, wallets, and addresses so Koinly could access my full transaction history. This was a simple process that only took a few minutes.

Importing Transactions from Exchanges

I connected my Coinbase, Binance, and Kraken accounts through API integration. This allowed Koinly to automatically import all of my buy and sell orders, deposits, and withdrawals. All I had to do was enter my API keys, which are provided by each exchange, and Koinly handled the rest.

Adding Transactions from Wallets and Addresses

For my hardware and software wallets like Ledger, Trezor, and Exodus, I could easily upload CSV files with my transaction histories. I also added the public addresses for any wallets I held crypto in so Koinly could scan the blockchain and find all associated transactions.

Reviewing and Tagging Transactions

Once Koinly imported all of my data, I reviewed each transaction to ensure accuracy. I tagged any deposits, withdrawals, staking rewards, mining payouts, gifts, donations, and lost or stolen crypto as needed for proper tax reporting. Koinly’s interface made the review and tagging process simple with bulk selection and tagging options.

Generating My Tax Reports

With all of my crypto transactions imported and reviewed in Koinly, I could instantly generate detailed capital gains, income, and gift tax reports for my accountant. Koinly provided audit trails, supporting documentation, and advisory notes for each taxable event to ensure my reports were fully compliant and ready to submit to tax authorities.

Using Koinly to aggregate my crypto transactions and generate tax reports saved me countless hours of manual work. The platform handled the entire import and reporting process so I could avoid confusion and feel confident my taxes were done right. For any crypto investor, Koinly is an invaluable tool for staying compliant while saving time and money.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Categorizing and Reviewing My Trades

Once you’ve connected all your wallets and exchanges to Koinly, the next step is to review and categorize your trades. This allows Koinly to accurately calculate your capital gains and losses for tax reporting.

Reviewing Your Trades

Koinly will automatically detect and categorize many of your transactions. However, it’s important that you manually review all trades to ensure proper categorization. Koinly makes this easy by showing you trades that need review first. Simply go through each transaction and select the appropriate category like “Trade,” “Gift,” “Income,” or “Loss.” For trades, be sure to specify if it was a “Buy” or “Sell.”

Categorizing Cryptocurrency Types

You’ll also want to categorize each of your cryptocurrencies as either “Currency” or “Utility token.” Currency categorization means the crypto is intended to be used as a digital currency to buy goods and services. Utility tokens provide access to a platform or service. Properly categorizing your crypto is important for calculating your capital gains and losses.

Handling Forks, Airdrops and Staking Rewards

If you received free crypto through forks, airdrops or staking, categorize these as “Income.” Koinly will then use the value of the crypto at the time you received it to determine your taxable income. You’ll owe income tax on the value of any crypto received through these activities.

Correcting Errors

Despite Koinly’s best efforts, some transactions may be categorized incorrectly. Carefully check that cost basis, proceeds, dates, and categories are right for all your trades. Make any necessary corrections before finalizing your tax report. Double check that your final capital gains and losses match your own records.

Going through this review and categorization process, while tedious, is the only way to ensure an accurate crypto tax report. Koinly makes the process as simple as possible, with an intuitive interface and helpful guidance along the way. With some time and patience, you’ll have a comprehensive report of your crypto capital gains and losses for the tax year.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Generating My Crypto Tax Reports

Once you’ve connected all your crypto exchanges and wallets to Koinly, it’s time to generate your tax reports. Koinly offers a variety of downloadable reports to suit your needs.

Capital Gains Report

The capital gains report provides a summary of all your cryptocurrency capital gains and losses for the tax year. It includes details like purchase date, cost basis, sale proceeds, gain/loss, and the holding period for each transaction. You can use this report to report your crypto gains and losses on your tax return.

Audit Trail

The audit trail report provides a full transaction history for your crypto portfolio. It includes details like the date, transaction hash, currency, amount, USD value, fees, and notes for each transaction. This report can be useful for your records or in the event of an audit by a tax authority.

Income Report

The income report summarizes all your cryptocurrency income for the tax year like mining, staking, interest, gifts, and income from crypto payments or services. The report provides details such as the date received, currency, amount, USD value, and income type for each transaction. You can use this to report additional crypto-related income on your tax return.

Yearly Summary

The yearly summary provides an overview of your cryptocurrency portfolio and transactions for the entire tax year. It includes metrics like your total portfolio value, realized and unrealized gains, income, donations, and trading volume. This high-level summary can give you valuable insights into your crypto investment performance and tax obligations for the year.

Koinly’s tax reports contain all the information you need to stay compliant and optimize your crypto taxes. The reports are downloadable as CSV files which you can then import into your tax filing software. Koinly has streamlined the entire crypto tax reporting process, saving you time and hassle. With Koinly handling your crypto taxes, you can focus on growing your digital asset portfolio.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Filing My Taxes – Stress Free!

Once tax season rolled around, I was dreading sorting through all my crypto transactions to report my capital gains and losses. However, using Koinly made the entire process stress-free.

Imported My Transactions Automatically

Koinly seamlessly imported all my transactions from the major crypto exchanges I use like Binance, Coinbase, and Kraken. It also pulled in my wallet transactions, staking rewards, airdrops, and DeFi activity. I didn’t have to manually enter a single transaction.

Calculated My Capital Gains

Koinly accurately calculated my capital gains across all my crypto assets based on the transaction data. It handled aspects like cost basis assignment, short and long term gains, and the specific tax rules in my country. I was able to review and verify the gain/loss for each transaction to ensure maximum accuracy.

Generated Compliant Tax Reports

With the click of a button, Koinly generated the necessary tax reports required by my local tax authority, including an audit trail report with all the details of every transaction. The reports were professionally formatted and ready to be submitted with my annual tax return. I didn’t have to worry whether my reports would satisfy the latest crypto tax regulations and guidelines.

Reasonable Pricing

For all the time Koinly saved me and the peace of mind it provided, its pricing was very reasonable. They offer a free plan for basic use as well as paid plans for more advanced crypto portfolios. I found the mid-tier plan suited my needs perfectly at an affordable annual price.

Using Koinly to report my crypto taxes was the best decision I made last year. It eliminated the stress, hassle, and uncertainty of doing it myself. If you own cryptocurrency, I highly recommend trying Koinly – your future self will thank you come tax season!

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Koinly Features I Love

Koinly offers many useful features that make the crypto tax reporting process simple and streamlined. Below are some of the Koinly features I have come to love.

Comprehensive Transaction Coverage

Koinly supports over 300 exchanges and wallets, covering more than 6,000 cryptocurrencies. No matter where you trade or which coins you hold, Koinly can likely integrate that data source and include those transactions in your tax reports.

Automated Data Import

Connecting your wallets and exchanges to Koinly is a breeze. Koinly offers an extensive list of supported integrations that allow you to automatically import your transaction data with the click of a button. For exchanges or wallets not supported, you can also manually upload CSV files or API keys to import data.

Tax Report Generation

With the click of a button, Koinly can generate the necessary tax reports for your country, including forms 8949, Schedule D, FBAR, etc. Koinly determines your capital gains, losses, and income to report by applying first-in-first-out cost basis and specific identification methods. You can then review, download and file the forms with your tax authority.

Portfolio Monitoring

In addition to tax reporting, Koinly provides useful portfolio monitoring tools. You can view charts showcasing your realized and unrealized gains, trading volume, asset allocation, and more. Koinly also gives you an overview of your current portfolio balance and details about each crypto holding like acquisition dates, costs, and average buy prices.

Customer Support

If you get stuck or have any questions, Koinly offers helpful customer support. You can reach the support team via live chat, email, or phone call. The Koinly support staff are knowledgeable about both cryptocurrency and taxes, so they can assist you with any issues that arise.

In summary, Koinly provides an all-in-one solution for cryptocurrency tax reporting and portfolio management with features that simplify the entire process. By automating data collection and calculation, generating the necessary tax forms, and providing useful portfolio analytics, Koinly helps make crypto tax reporting practically painless.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Koinly Crypto Tax Software FAQs

Koinly is an automated cryptocurrency tax reporting software that can help simplify your crypto tax reporting. By connecting your wallets and exchanges, Koinly can track your transactions, calculate your capital gains and losses, and generate tax reports.

What cryptocurrencies does Koinly support?

Koinly supports over 6,000 cryptocurrencies including major coins like Bitcoin, Ethereum, and Litecoin as well as smaller altcoins. As long as a coin is listed on CoinMarketCap, Koinly will likely support it for tax reporting.

How does Koinly calculate my crypto taxes?

Koinly uses a first-in-first-out (FIFO) cost basis method to calculate your capital gains and losses according to most countries’ tax laws. For each sale, Koinly will match it to your oldest unsold coins of the same type to determine your cost basis and capital gain. Koinly also supports last-in-first-out (LIFO) and highest-in-first-out (HIFO) methods if you prefer.

What tax reports does Koinly generate?

Koinly can generate tax reports for the U.S., U.K., Australia, Canada and over 30 other countries. The tax reports include an audit trail, capital gains report, income report, gift/donation report, and closing position report. The reports can be downloaded as PDFs and some are available in CSV format.

How much does Koinly cost?

Koinly has a free plan for those with under 100 transactions. Paid plans start at $49/year and go up to $299/year for high volume traders and fund managers. Koinly does not charge any hidden fees or take any commissions on your trades. Discounts are available if you pay annually instead of monthly.

Is my data secure with Koinly?

Yes, Koinly takes security very seriously and does not share your data with any third parties. Your data is encrypted at rest and in transit. Koinly is also SOC 2 Type 1 certified which means they have enterprise-level security controls and compliance. Only you have access to your Koinly account and tax reports. For added security, you can enable two-factor authentication on your Koinly account.

In summary, Koinly aims to simplify your cryptocurrency taxes through an automated solution to track your transactions, calculate capital gains and losses, and generate comprehensive tax reports to keep you compliant. By handling one of the biggest pain points of crypto investing, Koinly allows you to focus on growing your portfolio.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅

Conclusion

In summary, Koinly has proven to be an invaluable tool for simplifying your cryptocurrency tax reporting. The platform aggregates all your crypto transactions across exchanges and wallets into a single report that can be used to file your taxes accurately and avoid penalties. With an easy to use interface, robust security, and affordable pricing plans for users of all levels, Koinly gives you the peace of mind that your crypto taxes are handled properly. If you’ve been struggling to keep records of your crypto activity or are worried about reporting requirements, Koinly is a must-have solution. By automating the entire tax reporting process, Koinly allows you to focus on enjoying the growth of your crypto investments rather than stressing over taxes. Overall, Koinly is transforming how people handle cryptocurrency taxes for the better.

CLICK HERE TO EXPERIENCE KOINLY SOFTWARE✅✅